- During a pandemic, the only certainty is uncertainty

- To reduce risk, make sure you understand your own financial Ins & Outs

- How to plan for an uncertain future

Uncertainty is the only real certainty, and nothing is as uncertain as knowing the full health and economic impacts of a pandemic.

What can and should you do to reduce your financial risk and costs during the COVID-19 outbreak?

Start by sorting your financial “ins and outs” into buckets that will let you visualize your risk and the costs and effort required to mitigate the risk.

Major Ins:

- Salary

- Production bonuses

- Other sources of income: contract income, dividends, rental income, etc

Major Outs:

- Mortgage/Rent

- Student loan payment

- Auto payment

- Health insurance cost (above what your employer may cover)

- Other insurance costs

- Utilities: electric, gas, phone, internet, etc

- Food

- Transportation: fuel, etc.

Ask yourself: What if you lose some or all of your major Ins? What would that do to your ability to meet your major Outs? How difficult will it be to replace that income and how long can you continue to meet your major Outs?

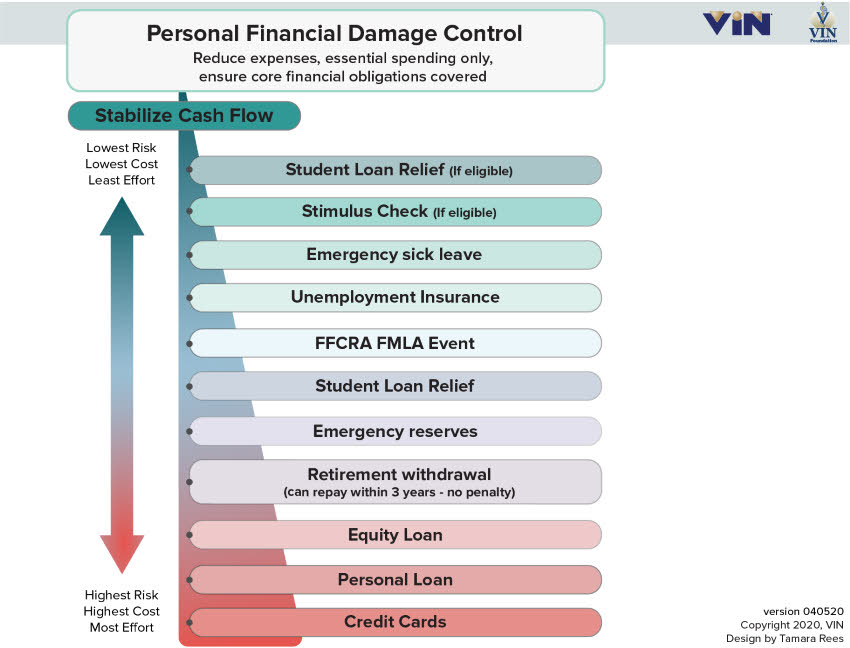

Handling the loss of some/all of your income

Whether you’re planning for or already dealing with a reduction in your income, the approach is the same:

- Reduce your Outs

- Supplement your Ins

It is difficult to reduce your major Outs. Here are some COVID-19 related tips:

- Mortgage/rent: Some banks and landlords are offering COVID-19 mortgage or rent relief. It is worth a call or email request to find out. Request or review the details of any relief offer. While some are very beneficial, others can be very costly. Make sure you understand the relief you are being offered.

- Student debt: If you have federally-owned student debt, you’re in luck! The CARES Act has suspended your federally held student loan interest and payments through at least 9/30/2020.

- You don’t have to request the suspension of your student loan interest or payments, and you will still get credit for on-time payments for the duration of the suspension. This is a rare benefit that falls into the no cost, low risk, low effort category.

- It may be tempting to continue paying your student loans during this suspension, but I refer you back to the uncertainty principle. This is an excellent opportunity to redirect what would have been student loan payments into your emergency reserves or to help you cover some of your other major Outs.

- Other major Outs: Relief really depends on the type of expense. Responses will vary, but it never hurts to be on the lookout for or call to ask for deferred or reduced payments for things like utility or insurance premium relief.

Next, look at your minor Outs -- everything not in that major Outs category -- and decide if those are “essential” expenses. This is not a time to continue those services that you don’t use or forgot that you are paying for. Start with anything that you pay for automatically. Go through the list. If you haven’t logged in or received some essential benefit from that service in the last 30 days -- cancel it.

Supplement your Ins

As a result of the CARES Act, many Americans will receive a no-cost, no risk, minimal effort stimulus check (depending on your tax filing status, adjusted gross income (AGI) and number of children). This is a one-time infusion to your Ins.

- File a tax return, even if your income does not require you to do so. If you’ve never filed a tax return before, there is also an Economic Impacts Payments process for non-filers.

- Review the income limits and filing requirements to see if you’re due a stimulus check

Unemployment Insurance, Emergency Sick Leave, and expanded Family and Medical Leave Act (FMLA) payments are available depending on the circumstances for you no longer working or working less. Review the VIN COVID-19 Information Center for more specific information, including technical breakdowns and flow charts to help you navigate your situation.

You may be able to lean on vacation time or personal time off to provide pay during some of the time you need to be away from work.

When your supplemental Ins fall short or you’ve cut back to bare essentials, that’s what emergency reserves are built for. Utilize your reserves to plug holes in your budget.

If you’re still working and receiving benefits but need to boost your cash flow to meet expenses, you may consider reducing your retirement contributions. This would be a low-mid cost, moderate risk, low effort move to help supplement your Ins. However, if you can afford it, this is a great time to maintain or even increase contributions to your retirement accounts or long-term investments -- your future-self will thank you! A more costly, risky, and still moderate effort option newly afforded by the CARES Act is the option to withdraw $100,000 from your retirement funds penalty-free. I would resist any retirement withdrawals unless absolutely necessary.

For the time being, debt is still very inexpensive. If you have equity in your home, this can be a great time to refinance your home or take out a line of credit against the equity in your home at low interest rates. This is an example of a low-moderate cost, moderate risk, moderate effort funding source, but is also highly dependent on your credit score and personal specifics.

Personal loans and credit cards round out the list -- but these are at the least favorable end of the risk and cost spectrum, especially with an unknown duration of impact to your income. But sometimes, you gotta do what you gotta do.

Adjust and adapt. Whether your income has already been affected, not affected yet, or may not be affected, this is the time to review your finances. For some, finances are scary. Trust me, medicine is much scarier. :-) Turn your clinical brains towards your finances -- measure your Ins & Outs and think about what you should do if your Ins decrease or your Outs increase. For this pandemic period, consider the short-term moves you can make to help balance your Ins and Outs. If you end up not being financially impacted, you can turn that focus on long-term moves as we all gain a bit more certainty.'.

No matter how stable you perceive your situation to be, the most responsible thing you can do in an uncertain time like this is act like it will become less stable if it hasn't already. The best thing you can do is understand your own financial Ins & Outs, so you have a plan for how you can earn or save more and spend less. And since the question isn't if there will be damage but how much, the best approach to these uncharted waters is Personal Financial Damage Control.

We’re all learning on the fly during this pandemic and things seem to change almost daily. Ask a lot of questions. Scrutinize everything. Be willing to adjust if/when necessary. As Paul’s been saying, “Please be safe, be kind to each other, and wash your hands.”